are union dues tax deductible in oregon

Susan - Union dues does not fit into the adjustments to income section of the Form 1040 and cant be use in that way to reduce income. Oregon personal income tax.

![]()

Deducting Union Dues H R Block

The deduction must meet the IRS limitations on miscellaneous itemized.

. Union dues is correctly shown on. Note that this is a reduced percentage. Effective in 2019 union members can NOW deduct their union dues from state taxes provided they itemize deductions.

Four years have passed since union dues havent been deducted from federal taxes and many lawmakers are attempting to bring it back and make it deductible without itemizing. The answer to your question is that the deduction for union dues and all employee expenses has been eliminated for tax years 2018 through 2025 regardless of. You can deduct dues and initiation fees you pay for union membership.

Please note that tax payers can now itemize deductions on state. If youre self-employed you can deduct union dues as a business expense. You may be able to deduct your union dues if you itemize deductions Schedule A.

Approximately 62 of the total of NEA OEA and Local association dues may be included as a miscellaneous itemized deduction on 2017 tax returns. These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized. Can my employer deduct fees for processing garnishments.

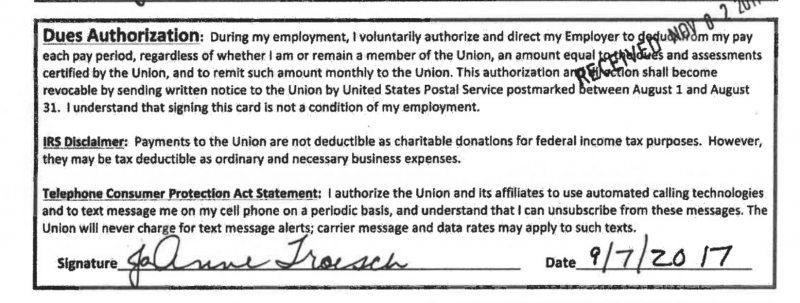

However most employees can no longer deduct union dues on their federal tax return in tax. Youll see the amount. Dues are deducted directly from each paycheck and sent by the employer directly to the union office.

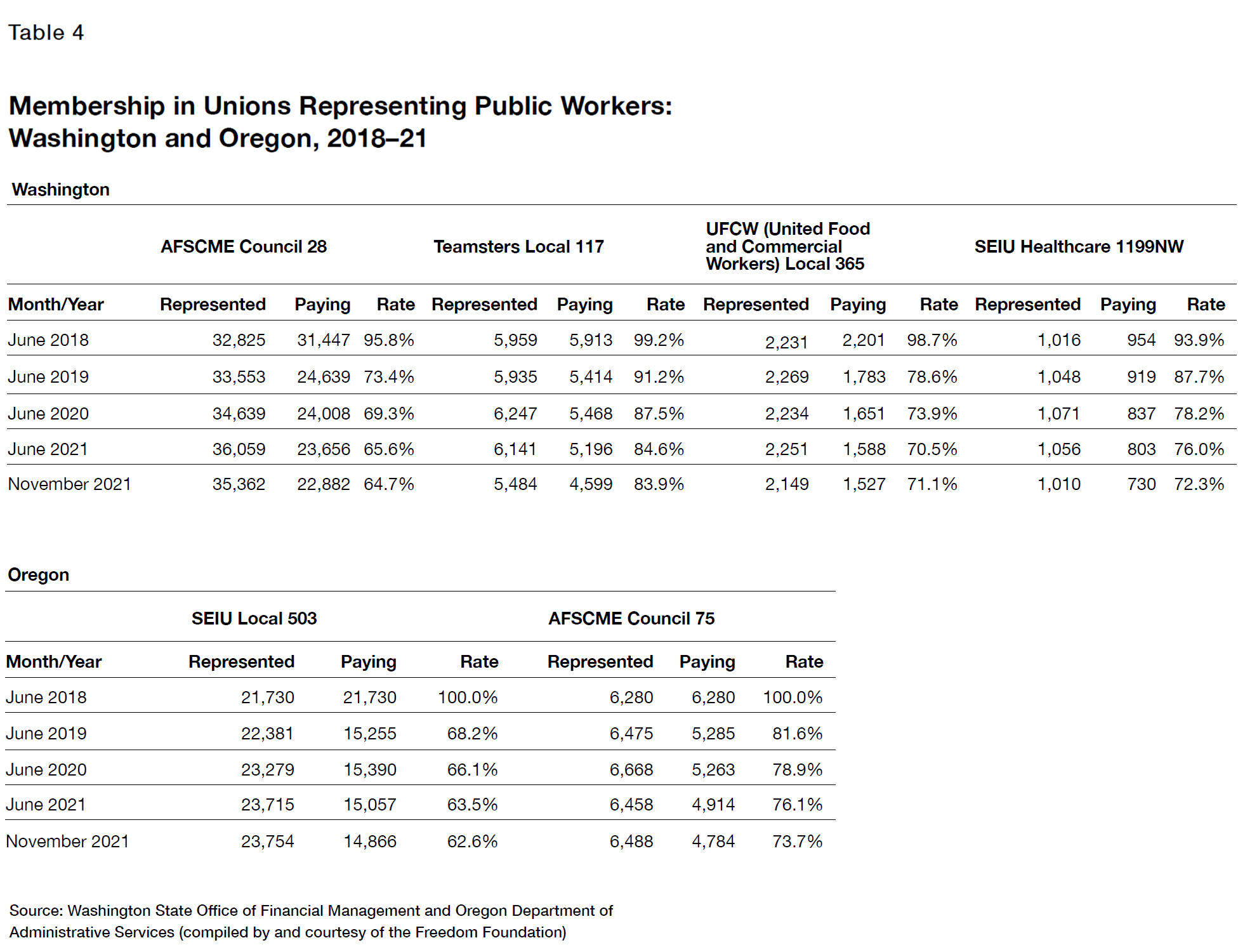

The 2018 Tax Reform Act changed. Its bad enough when public-sector unions pick the pockets of their own members. SEIU Continues Deducting Dues Even After Members Change Unions.

Prior to 2018 an employee who paid union dues may have been able to deduct their dues as unreimbursed employee business expenses. Because of the recent Supreme Court ruling in Janus v. Union dues are included in job-related expenses and are not fully deductible as they are subject to the 2.

Over 1000 technical and engineering employees working for the State of Oregon are represented by the Association of Engineering Employees AEE. As an OEA member you may be able to deduct your OEA NEA and EEA Local dues on your 2013 income tax return. The floor report notes that though union dues are already tax deductible union workers are more likely to not itemize their deductions and therefore do not get the same tax.

Deductions and modifications for part-year and nonresident filers. For years state employees were required. UNION DUES CANNOT BE DEDUCTED FROM GOVERNMENT EMPLOYEES IN Oregon WITHOUT CONSENT.

An employer may collect a 2 processing fee for each week of wages garnished under ORS 18736. Most union employees are on dues checkoff. Part-year and nonresident filers report these deductions and.

Give Your Union A Dues Checkup Labor Notes

By The Numbers Public Unions Money And Members Since Janus V Afscme Manhattan Institute

Why All Workers Should Be Able To Deduct Union Dues Center For American Progress

Two Of Oregon S Largest Unions See Decline In State Workers Paying Dues But Claim They Re Bouncing Back Salem Reporter

Paychecks And Deductions Google Sheets Tiller Community

New Business Travel Per Diem Rates Announced For 2020

Corvallis Gazette Times From Corvallis Oregon On April 2 1997 3

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

Apr 1 Paid The Treasurer Of The Chegg Com

8 Common Child Support Questions Answered Goldberg Jones

Union Payroll 101 Taxes And Fringes Union Dues Vacation Fund Fca International

Janus Round Two Supreme Court To Decide Whether To Hear Case Of Teachers Who Say Union Dues Violate First Amendment Rights The 74